Ensuring tax compliance is a fundamental aspect of operating a business. In the United States, businesses are obligated to report contractor fees as miscellaneous expenditures through tax forms. While the 1099 forms detail the compensation provided to independent contractors, another crucial form must accompany them - Form 1096.

Understanding IRS Form 1096

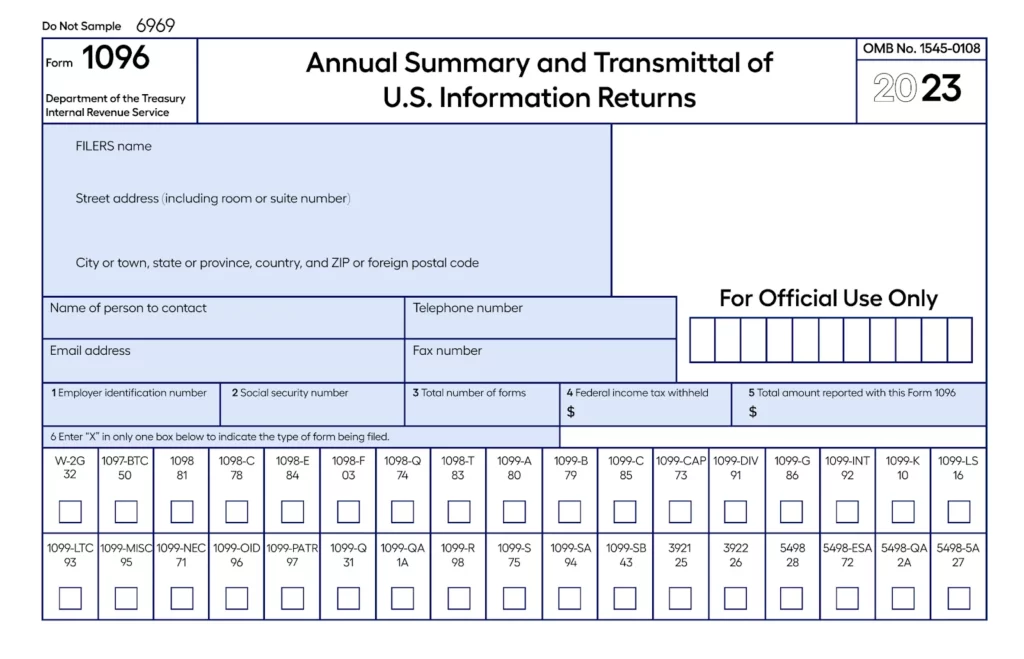

IRS Form 1096, officially known as the Annual Summary and Transmittal of U.S. Information Returns, serves as a summary of various accompanying documents, including W-2G, 1097, 1098, 1099, 3921, 3922, and 5498. Business owners must recognize the significance of Form 1096, grasp the acquisition process, and understand the filing procedures. This comprehensive guide addresses these concerns and offers tips to streamline the tax reporting process.

Distinguishing Between Form 1096 and Form 1099

Although the names of Form 1096 and Form 1099 sound similar, their purposes are distinct. Form 1099 records payments exceeding $600 made by a business to its contractors. Businesses issue 1099 forms to contractors and submit a copy to the IRS. Form 1096, on the other hand, summarizes the details of various 1099 forms and is submitted when the taxpayer files them via mail.

Acquiring Form 1096

Obtaining Form 1096 is a straightforward process:

1. Visit www.IRS.gov/orderforms to order Form 1096.

2. Navigate to "Online Ordering for Information Returns" and specify the quantity of 1096 forms required.

3. Add the forms to the cart and proceed to checkout.

IRS provides these forms free of charge, and delivery typically takes ten business days. It's crucial to use the official IRS website for obtaining scannable forms to avoid penalties.

Filling Out Form 1096: Step-by-Step Instructions

Step 1: Business Information

Before completing Form 1096, fill out accompanying forms such as 1099-MISC. The number of forms filled determines the number of 1096s required.

Step 2: Basic Information

Provide essential information in the upper-left corner, including filer's name, address, contact details, and the name of the person to contact.

Step 3: Box 1 or 2, and Box 3

Enter the Employer Identification Number (EIN) in Box 1 or Social Security Number in Box 2. Box 3 requires the total number of forms being submitted.

Step 4: Boxes 4 and 5

Box 4 requires the federal income tax withheld, and Box 5 needs the total amount reported with Form 1096.

Step 5: Boxes 6 and 7

Box 6 involves checking the appropriate entry indicating the information return being submitted. Box 7 requires a checkmark if submitting a 1099-MISC form.

Step 6: Review and Submission

Review the form for accuracy, sign, date, and mail the original documents to the IRS address before the due date.

Tips for US Employers Filing Form 1096

1. Consider Filing Electronically

E-filing streamlines processes, saves time, and eliminates the need for Form 1096 when filing electronically.

2. Invest in Payroll Software

Payroll or accounting software simplifies tax filing processes and ensures quick access to crucial information.

3. Collaborate with Experts

Seeking assistance from tax professionals ensures accurate filing, adherence to regulations, and timely submissions.

Remoly - Streamlining Global HR Management

Global businesses must classify employees and contractors correctly to comply with tax regulations. Improper classification can lead to penalties and legal issues. Remoly's Employer of Record (EOR) solution simplifies global workforce management, ensuring compliance with local and global labor laws.

FAQs

1. Can I submit Form 1096 online?

No, Form 1096 is for physical forms and cannot be submitted online. E-filing for other forms associated with the 1096 is done through the IRS's FIRE system.

2. Who has to submit a 1096 form?

Employers or taxpayers are responsible for submitting Form 1096 via mail. Employees and contractors are not required to submit this form when filing income returns.

3. When is Form 1096 due?

The deadline is January 31 for submitting Forms 1096 and 1099-NEC together. For other forms, the due dates vary, with March 31 being the deadline for certain e-filing submissions.

4. What are the penalties for late submission?

Penalties range from $50 to $570 per form, depending on the timing of submission and whether it was an intentional failure to file.

Easy to start,

intuitive to use