Understanding the complete breakdown of salary and employment costs is crucial for businesses and employees alike. With Remoly, this process is straightforward. Follow this easy guide to accurately calculate the costs associated with employment, including taxes and contributions, tailored to specific countries and currencies.

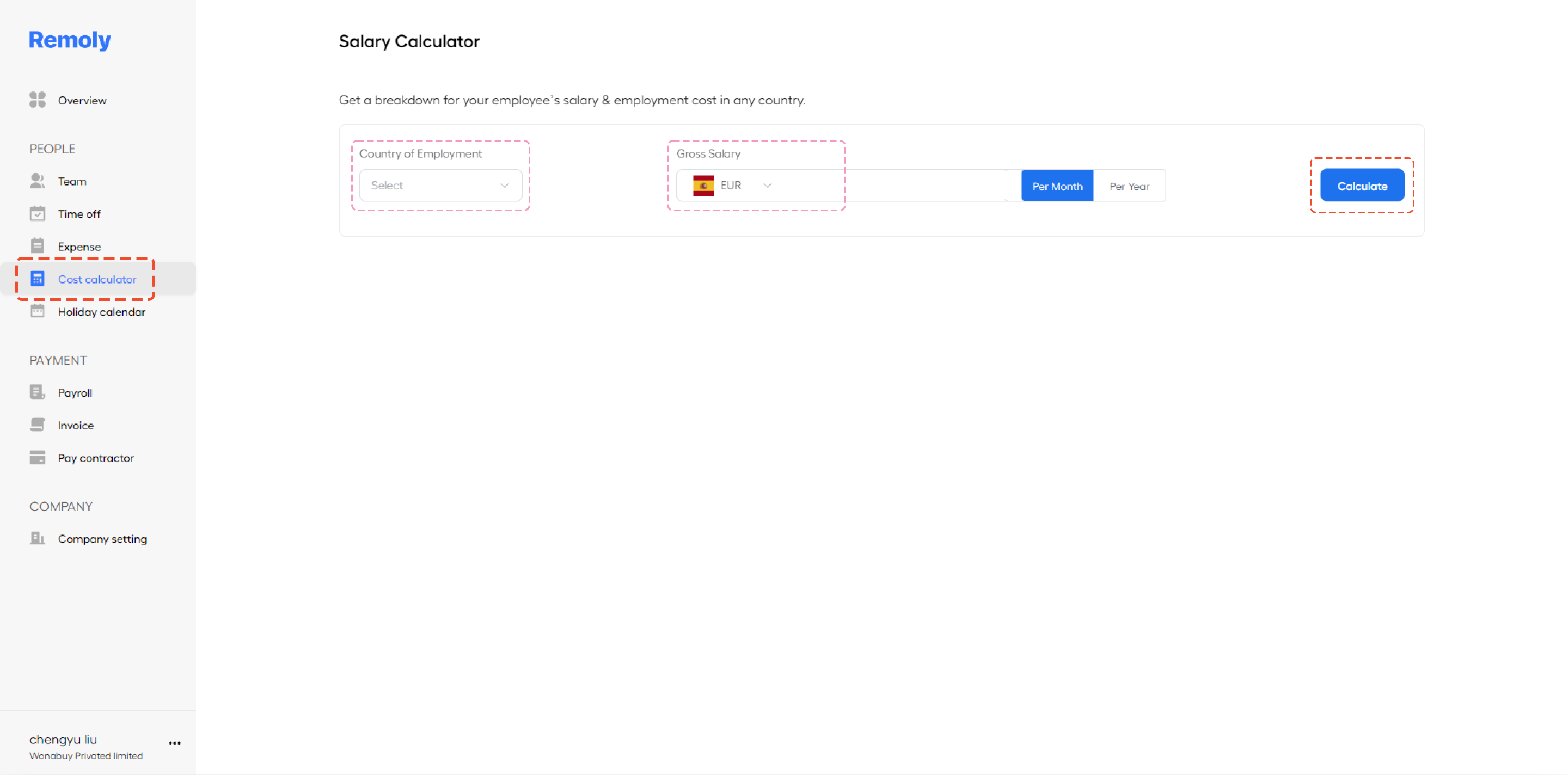

1. Access the Cost Calculator

Begin by navigating to the "Cost Calculator" feature on Remoly's platform. Here, you’ll be prompted to select the country of employment and the preferred currency. This step is essential as employment costs vary significantly depending on the location and currency.

2. Enter the Gross Salary Amount

Next, input the gross salary amount. Ensure that the value you enter is greater than zero, as this will form the basis for the cost breakdown. The gross salary is the total income before any deductions such as taxes and social contributions.

3. Calculate the Breakdown

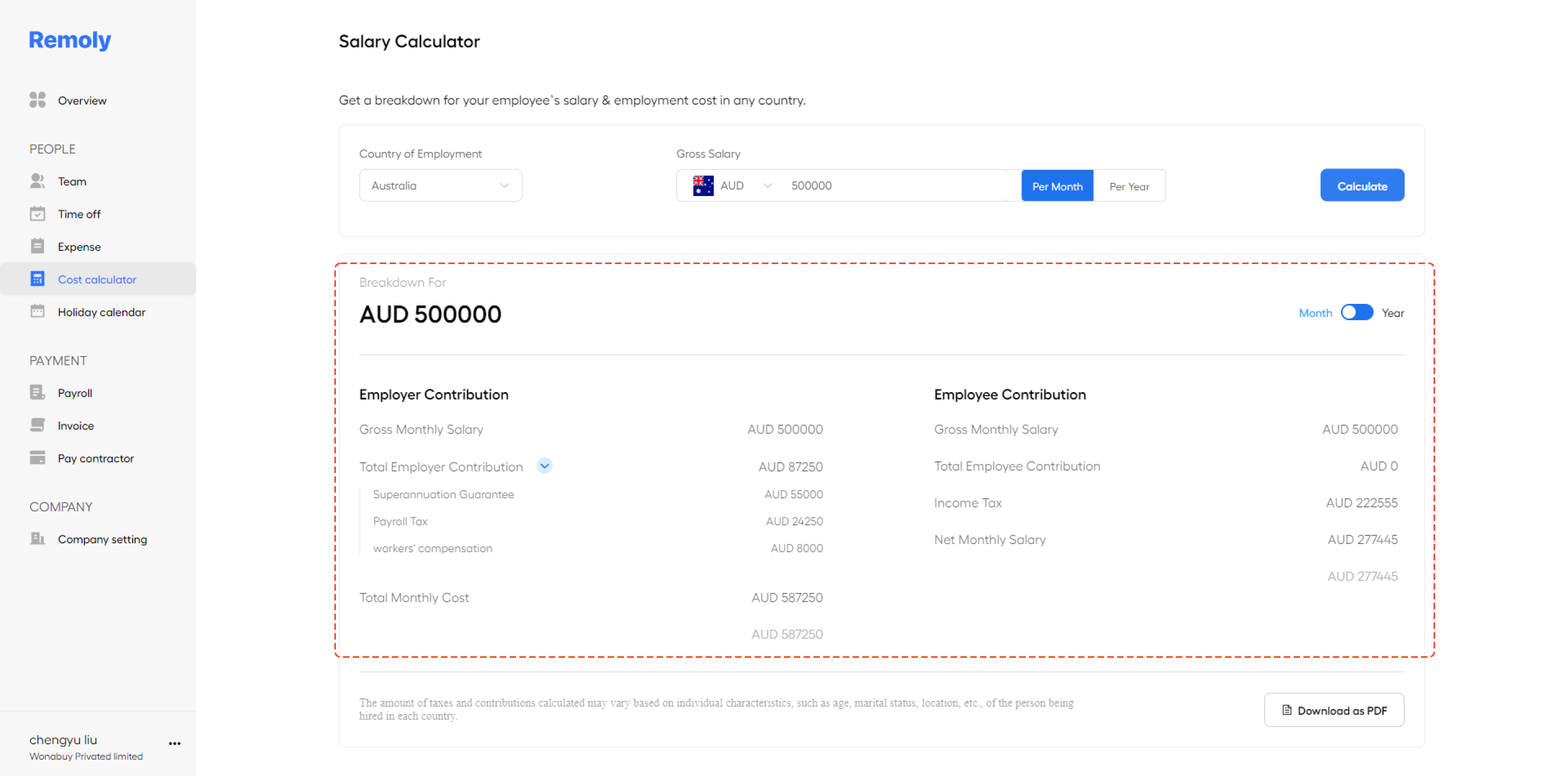

After entering the gross salary, click the "Calculate" button. Remoly will process the information and provide a detailed breakdown of the employment costs. This breakdown will include various components such as taxes, social security contributions, and other relevant deductions based on the country selected.

Important Considerations

The breakdown displayed by Remoly is tailored to the specific details provided. However, it’s important to note that calculated taxes and contributions may vary depending on individual characteristics. Factors such as age, marital status, and the exact location within the country of employment can influence the final figures. Therefore, while Remoly provides an accurate estimate, individual circumstances might result in slight variations.

By following these steps, you can easily obtain a comprehensive understanding of employment costs, helping you make informed financial decisions whether you're an employer or employee.

Easy to start,

intuitive to use